How Generative AI is Transforming Financial Audits: A Comprehensive Guide

Financial audits are the backbone of corporate governance—think of them as the financial world’s equivalent of a health check-up. They ensure transparency, compliance, and trust in financial reporting, which is absolutely crucial in today’s business landscape. For modern businesses, maintaining rigorous financial oversight isn’t just a regulatory requirement; it’s a competitive necessity. Yet traditional audit processes have long been the proverbial thorn in the side of finance teams—time-consuming, resource-intensive, and frustratingly susceptible to human error.

Picture this: stacks of documents, countless spreadsheets, and auditors burning the midnight oil trying to spot discrepancies that could make or break a company’s financial standing. It’s like looking for a needle in a haystack, except the haystack keeps growing and the needle might not even be there. As the need for efficiency and accuracy intensifies in our fast-paced business environment, Artificial Intelligence (AI), particularly Generative AI (GenAI), is stepping up to the plate and transforming the audit landscape in ways that would have seemed like science fiction just a few years ago.

The integration of GenAI into auditing isn’t just a trend—it’s a revolution that’s already underway. Consider this: 41% of chief audit executives are either currently using or planning to implement GenAI within this year. That’s not just dipping their toes in the water; that’s diving headfirst into the deep end. Organizations are recognizing that AI adoption in audit functions isn’t just nice-to-have anymore—it’s becoming as essential as having a solid accounting system. Industry experts predict that AI usage in auditing will double to 80% by 2026, which means we’re witnessing the early stages of a complete transformation.

In this comprehensive guide, we’ll explore how GenAI revolutionizes the financial audit workflow, breaking down each stage like a master chef explaining a complex recipe. We’ll highlight its transformative impact while showcasing how Alpha Net’s AI solutions streamline audits for companies of all sizes—from scrappy startups to Fortune 500 giants.

The AI-Enhanced Audit Workflow: A Step-by-Step Breakdown

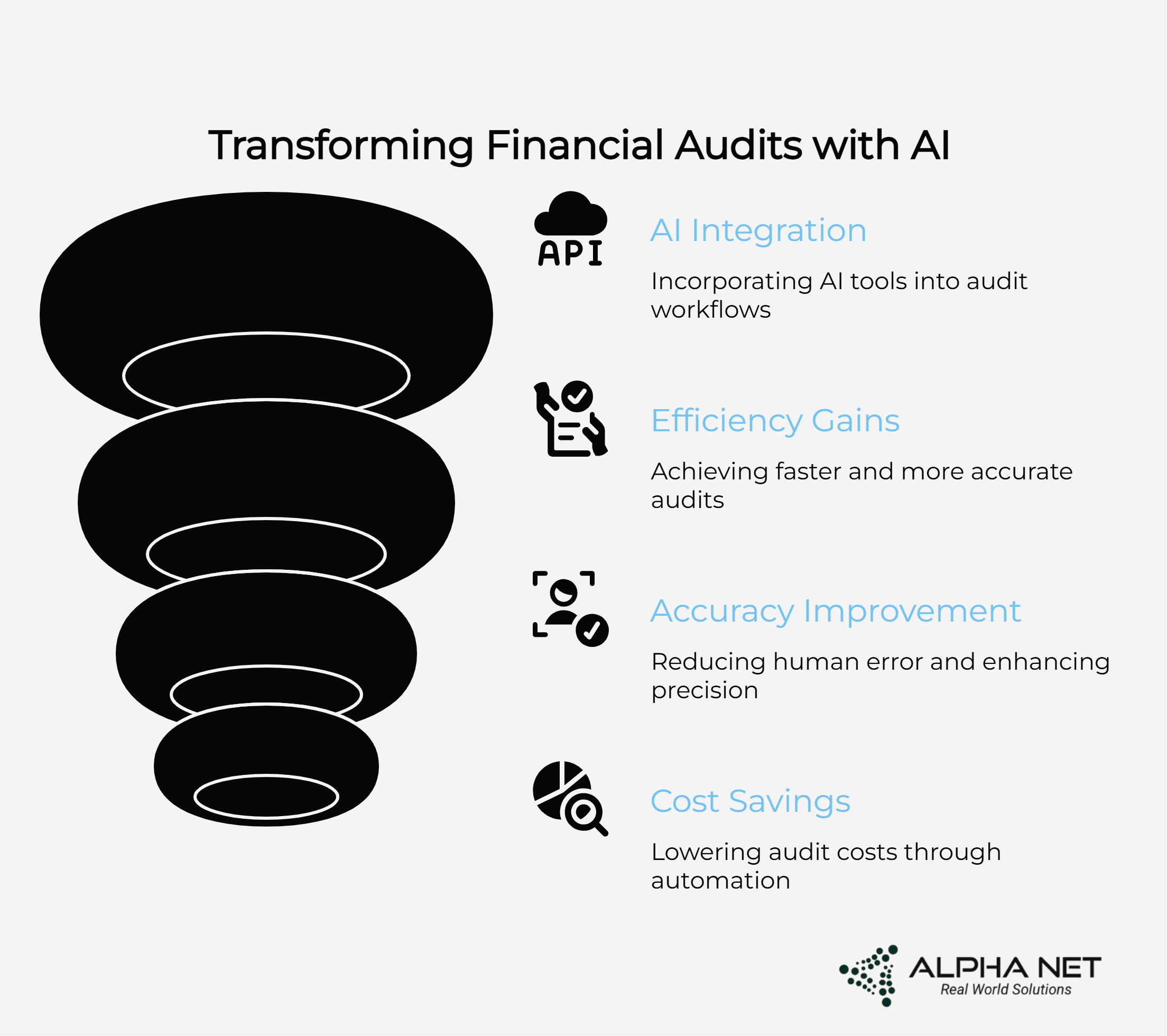

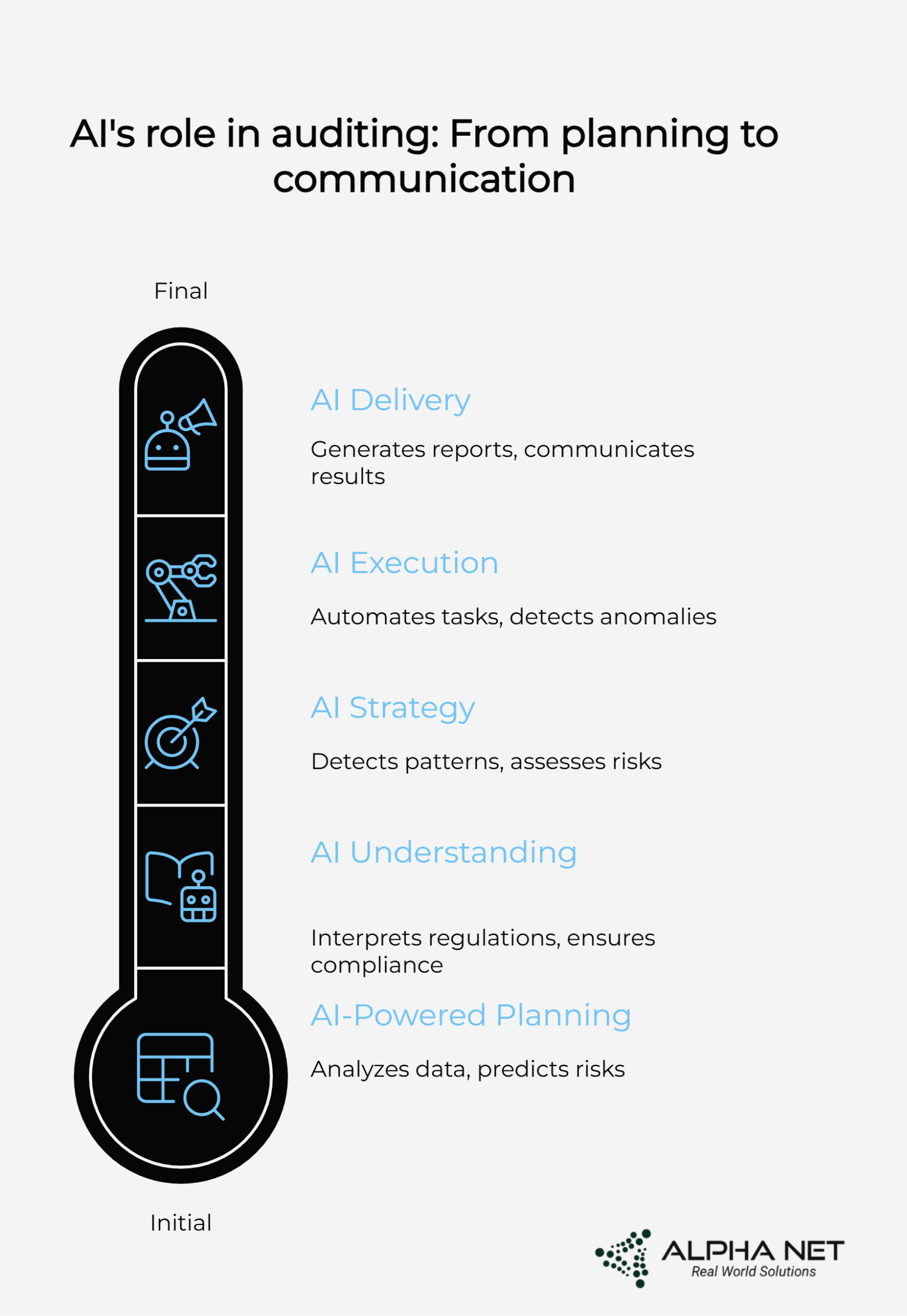

A financial audit follows a structured process that’s more methodical than a Swiss watchmaker’s routine. Modern AI audit software is transforming each of these traditional audit phases. It typically encompasses five key stages: planning the engagement, understanding the engagement, scoping and strategy, execution, and conclusions and delivery. Each stage presents unique opportunities for GenAI enhancement, delivering efficiency gains that would make even the most productivity-obsessed CEO smile.

1. AI-Powered Audit Planning and Engagement

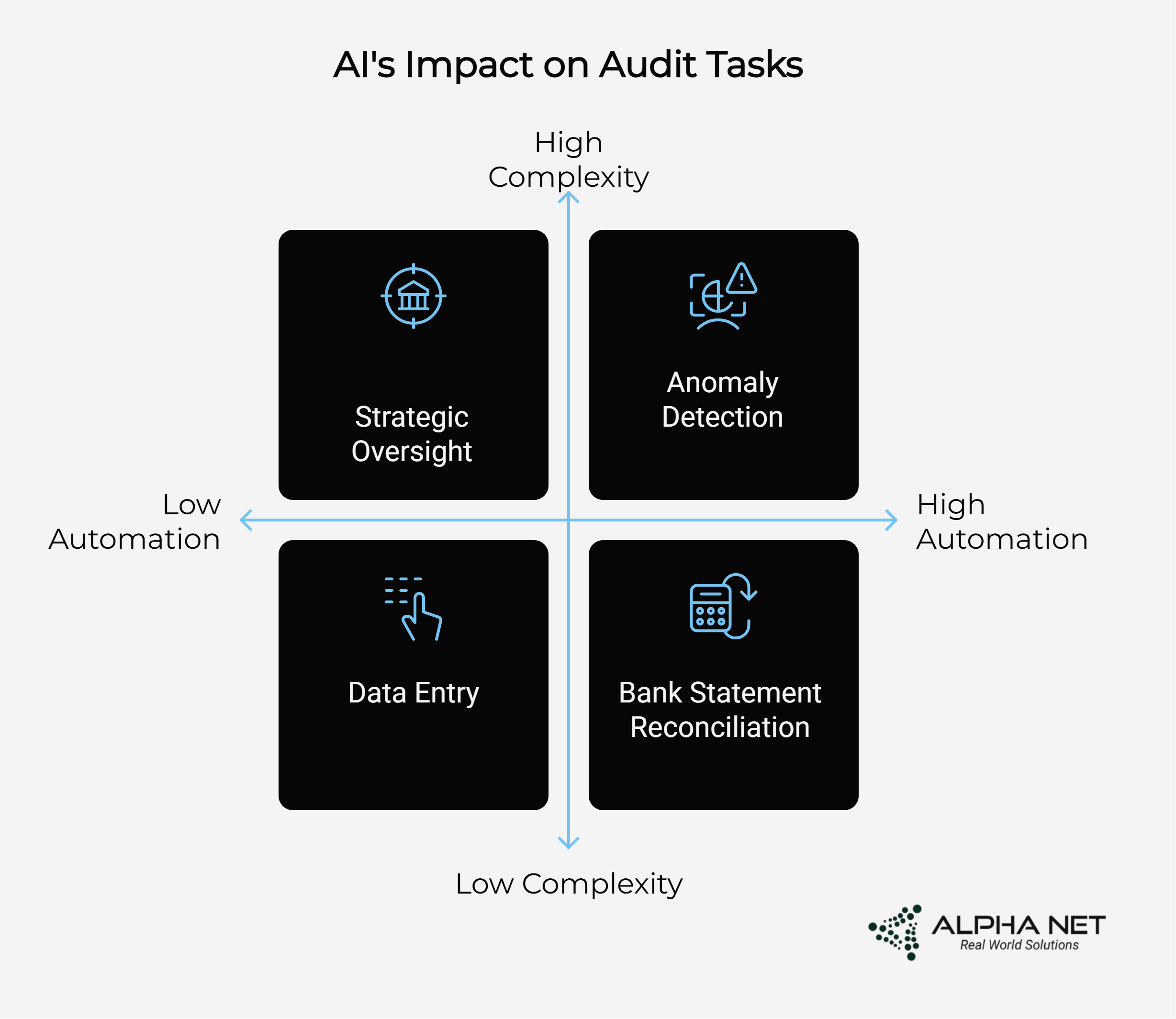

The Traditional Challenge: Manual audit planning requires auditors to define scope by analyzing historical data, identifying high-risk areas, and allocating resources—a process that traditionally takes days or weeks. It’s like planning a cross-country road trip without GPS, relying on old maps and hoping you don’t miss any important stops along the way.

How AI Transforms Audit Planning: Generative AI and machine learning audit tools analyze vast datasets—past audits, financial statements, industry trends, and regulatory changes—using algorithms that work faster than a caffeinated data analyst. The technology’s document intelligence capabilities allow it to review and summarize vast repositories of information, extracting crucial insights from previous audit findings and regulatory changes in a fraction of the time it would take human auditors.

Think of it as having a brilliant research assistant who never sleeps, never gets tired, and can process information at superhuman speeds. AI doesn’t just read documents; it understands context, identifies patterns, and makes connections that might escape even experienced auditors. It can predict high-risk areas with remarkable accuracy, ensuring a more focused and efficient scope from the outset.

Example: AI could flag unusual transaction patterns in a company’s supply chain finances—perhaps detecting that payments to certain vendors spike dramatically during specific months, which could indicate everything from seasonal business patterns to potential fraud schemes. This early detection enables auditors to prioritize these areas right from the start, rather than stumbling upon them weeks into the audit process.

2. Understanding the Engagement

The Challenge: Auditors need to comprehend applicable standards, regulations, and methodologies, often sifting through dense legal and financial documents that read like they were written by lawyers for lawyers. It’s like trying to navigate a maze blindfolded while someone shouts directions in a foreign language.

AI’s Role: With Natural Language Processing (NLP), a sophisticated subset of GenAI, AI rapidly scans and interprets regulatory texts, extracting relevant standards like GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards). This dramatically reduces manual review time while ensuring compliance with current regulations. Advanced language models can generate professional audit communications with remarkable consistency and regulatory compliance, maintaining the formal tone and precise language that audit documentation requires.

The beauty of AI in this context is its ability to stay current with regulatory changes. While human auditors might miss a subtle update to accounting standards buried in a 200-page regulatory document, AI systems can instantly identify and highlight these changes, ensuring audits remain compliant with the latest requirements.

Example: AI could instantly notify auditors when international tax regulations affecting a company’s global operations are updated, automatically flagging which specific sections of the audit might be impacted. This proactive approach prevents the all-too-common scenario where auditors discover regulatory changes halfway through an audit, requiring costly and time-consuming rework.

3. Understanding Scope and Strategy

The Challenge: Processing extensive business data to understand operations, identify risks, and craft an audit strategy is like trying to drink from a fire hose. For large organizations with complex operations spanning multiple jurisdictions, this becomes even more daunting.

AI’s Role: GenAI analyzes financial statements, operational reports, market data, and industry benchmarks to detect patterns, anomalies, and risks that might be invisible to human analysis. Machine learning algorithms create comprehensive risk assessment frameworks using industry-specific templates and analyze historical data patterns to identify potential problem areas with surgical precision.

AI doesn’t just process data—it understands relationships between different data points, creating a holistic view of organizational risk. It can identify subtle correlations between seemingly unrelated business activities, helping auditors understand the full scope of potential audit areas.

Example: AI might identify inconsistencies in revenue recognition across different geographic regions, perhaps noticing that the company’s European division consistently recognizes revenue earlier in the quarter compared to its North American operations. This insight guides auditors to focus on potential misstatements and ensures consistent application of accounting policies across all business units.

4. Execution

The Challenge: This phase involves the most labor-intensive tasks—data analysis, control testing, evidence collection, and transaction sampling. It’s where human error can creep in like an uninvited guest at a dinner party, potentially compromising the entire audit’s integrity.

AI’s Role: GenAI automates routine tasks such as data entry, reconciliations, and preliminary analysis while providing real-time risk assessment and anomaly detection. This allows auditors to focus on strategic oversight and complex judgment calls that require human expertise. Machine learning algorithms excel at pattern recognition, analyzing transactional data to identify unusual patterns and potential fraud indicators with the persistence of a bloodhound and the accuracy of a surgical instrument.

AI can process thousands of transactions in minutes, performing complex analytical procedures that would take human auditors days or weeks to complete. It can identify outliers, unusual patterns, and potential red flags with consistent accuracy, ensuring nothing falls through the cracks.

Example: AI could reconcile bank statements with ledger entries across thousands of accounts, flagging discrepancies in seconds rather than hours. More impressively, it could identify subtle patterns like payments that consistently occur just before month-end, which might indicate attempts to manipulate financial results through timing differences.

5. Conclusions and Delivery

The Challenge: Compiling findings, drafting reports, and communicating results to stakeholders can be as tedious as watching paint dry, yet it’s crucial for stakeholder understanding and regulatory compliance.

AI’s Role: GenAI generates summaries, audit memos, and draft report sections with remarkable consistency and clarity, ensuring that complex financial information is communicated effectively to different audiences. Multi-format report generation creates comprehensive documents tailored for different stakeholder groups—from technical audit committees to executive management—all from a single data source.

The AI can adapt its communication style based on the intended audience, using technical language for audit professionals while creating executive summaries that focus on strategic implications and business impact.

Example: AI could produce an executive summary that highlights key risks and recommendations in a polished, stakeholder-ready format, while simultaneously generating detailed technical appendices for audit committee review. This ensures that everyone gets the information they need in the format they can best understand and act upon.

GenAI’s Role in Each Stage of the Audit Journey

GenAI enhances every step of the external auditing process like a master conductor orchestrating a symphony. Based on industry analysis and real-world implementation data, here’s how GenAI transforms each audit stage with measurable results:

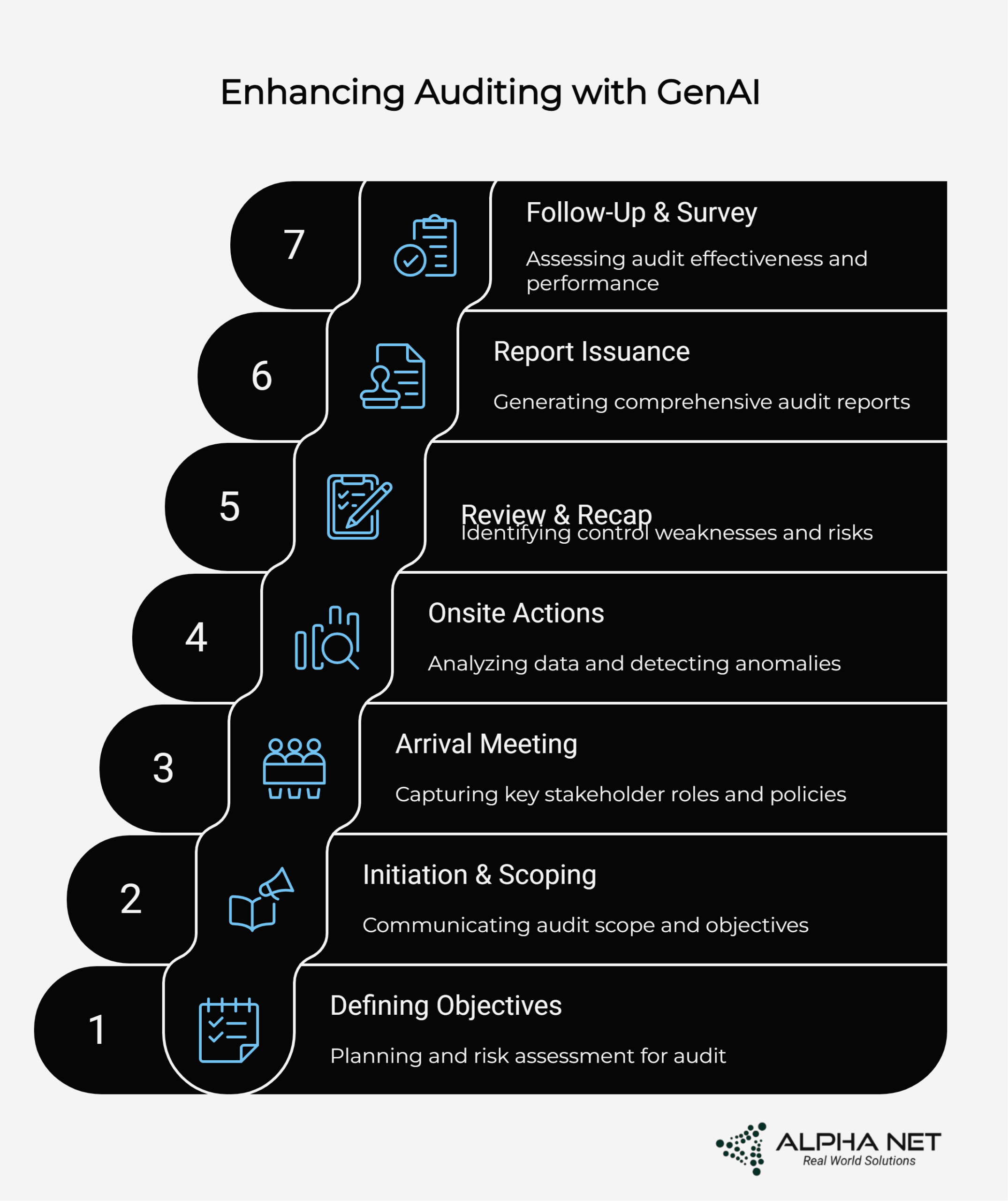

Defining Objectives – Smart Audit Planning

Activities: Planning, information gathering, developing audit programs, defining testing procedures, and reviewing previous years’ results—essentially laying the foundation for the entire audit.

GenAI’s Role: Reviews and summarizes large volumes of documents with the efficiency of a speed reader who never forgets anything. Provides audit review citations and categorization, helps define audit programs and testing procedures based on risk assessment, creates comprehensive risk assessment frameworks, and initiates audit process roadmaps using intelligent templates that adapt to specific industry requirements.

Effort Reduction: Up to 40%—imagine cutting nearly half the time spent on audit planning while improving the quality of that planning.

Initiation & Scoping – AI-Enhanced Communication

Activities: Communicating scope and audit areas, issuing memos to management, introducing audit objectives, reviewing process details, and setting expectations with stakeholders.

GenAI’s Role: Generates professional memos and communications that maintain consistent tone and messaging, communicates audit objectives using advanced language models that ensure clarity and compliance, and extracts necessary procedures and standards from regulatory frameworks.

Effort Reduction: Up to 25%—a significant time savings that allows auditors to focus on relationship building and strategic discussions rather than document drafting.

Arrival Meeting – Intelligent Information Capture

Activities: Reviewing major programs and operations, understanding key stakeholder roles and responsibilities, understanding policies and procedures, and establishing working relationships.

GenAI’s Role: Provides comprehensive meeting notes and transcript summaries that capture every important detail, extracts key points about stakeholder roles, policies, and terms, and ensures all participants are aligned without requiring manual note-taking that can distract from active listening.

Effort Reduction: Up to 30%—allowing auditors to be fully present in meetings while ensuring nothing important is missed.

Onsite Actions – Advanced Data Analytics

Activities: Data gathering, understanding internal controls through audit testing, reviewing system controls, checking data integrity and completeness, and performing substantive testing procedures.

GenAI’s Role: Analyzes transactional data to identify patterns and anomalies with machine precision, detects potential fraud using synthetic data generation and advanced analytics, performs impact analysis with scenario generation techniques, and automates data gathering and evidence requests.

Effort Reduction: Up to 30%—transforming the most time-consuming phase of auditing into a streamlined, efficient process.

Review & Recap – Intelligent Findings Management

Activities: Identifying control weaknesses, policy violations, communicating findings to management, and addressing risks and remedial measures.

GenAI’s Role: Documents initial findings with consistent formatting and language, identifies control weaknesses and policy violations through pattern analysis, communicates risks and remedial measures in clear, actionable language, and automates task creation and tracking for audit phases.

Effort Reduction: Up to 20%—ensuring that findings are properly documented and communicated without administrative burden.

Report Issuance – Automated Reporting Excellence

Activities: Providing formal responses and action plans, issuing formal audit reports, filing with regulators, and creating audience-specific reports.

GenAI’s Role: Generates comprehensive audit reports that meet regulatory requirements, performs regulatory compliance checks using Large Language Models (LLMs) trained on audit standards, and tailors reports for specific audiences while maintaining consistency in findings and recommendations.

Effort Reduction: Up to 15%—streamlining the final stages of audit delivery while ensuring quality and compliance.

Follow-Up & Survey – Comprehensive Feedback Management

Activities: Summarizing audit effectiveness, assessing auditor performance, following up on significant findings, and checking adherence status of recommendations.

GenAI’s Role: Creates targeted surveys and feedback forms, distributes them efficiently, and analyzes responses to summarize audit effectiveness and auditor performance, providing actionable insights for continuous improvement.

Effort Reduction: Up to 50%—the highest efficiency gain, transforming post-audit activities from administrative burdens into strategic learning opportunities.

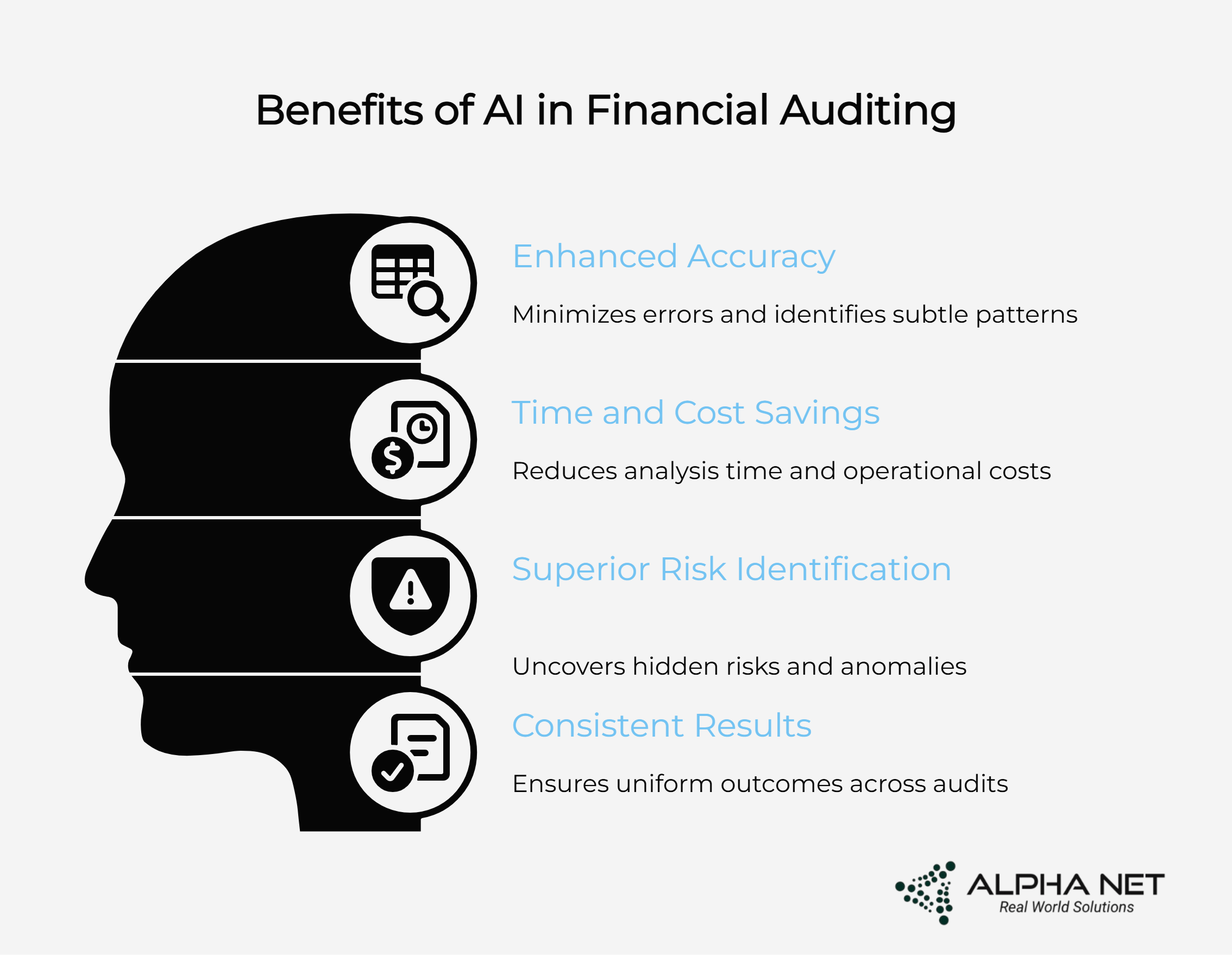

Key Benefits of AI-Powered Financial Auditing

Enhanced Accuracy and Automated Quality Control

AI-powered audit tools minimize human error in data analysis and repetitive tasks like a quality control specialist who never has an off day. Automated financial auditing systems analyze large datasets with robotic precision, drastically reducing computational mistakes while identifying patterns and anomalies that could be missed by even the most experienced human auditors. This isn’t just about catching more errors—it’s about identifying subtle patterns and irregularities that would be impossible to detect through manual review.

The consistency of AI analysis means that the same transaction will be evaluated identically every time, eliminating the variability that can occur when different auditors apply slightly different approaches to similar situations.

Significant Time and Cost Savings

AI can reduce data analysis time by up to 50%, freeing auditors to focus on higher-value analytical work that requires human judgment and expertise. Automating routine tasks and accelerating the auditing process leads to substantial cost savings, with firms able to reduce both the time and resources spent on audits while improving overall quality.

Organizations implementing automated audit solutions typically experience comprehensive cost reductions that improve both short-term profitability and long-term financial health. The ripple effects include faster time-to-market for financial reporting, reduced disruption to business operations, and improved resource allocation.

Superior Risk Identification

AI uncovers risks—like fraud, misreporting, or control weaknesses—that might otherwise remain hidden in the vast sea of financial data. Machine learning algorithms analyze relationships between seemingly unrelated transactions, identify unusual timing patterns, and detect subtle manipulations that skilled fraudsters might use to evade conventional detection methods.

AI’s ability to analyze data in real-time helps identify risks and anomalies before they can have significant negative impact, transforming audit from a reactive compliance exercise into a proactive risk management tool.

Consistent Results and Standardization

Standardized AI processes deliver repeatable, uniform outcomes across audits, regardless of who’s conducting them or when they’re performed. While human auditors might apply testing procedures differently based on experience levels, workload pressures, or even mood, AI systems execute procedures identically every time.

This consistency not only improves audit quality but also creates more reliable benchmarks for year-over-year comparisons and cross-organizational analysis.

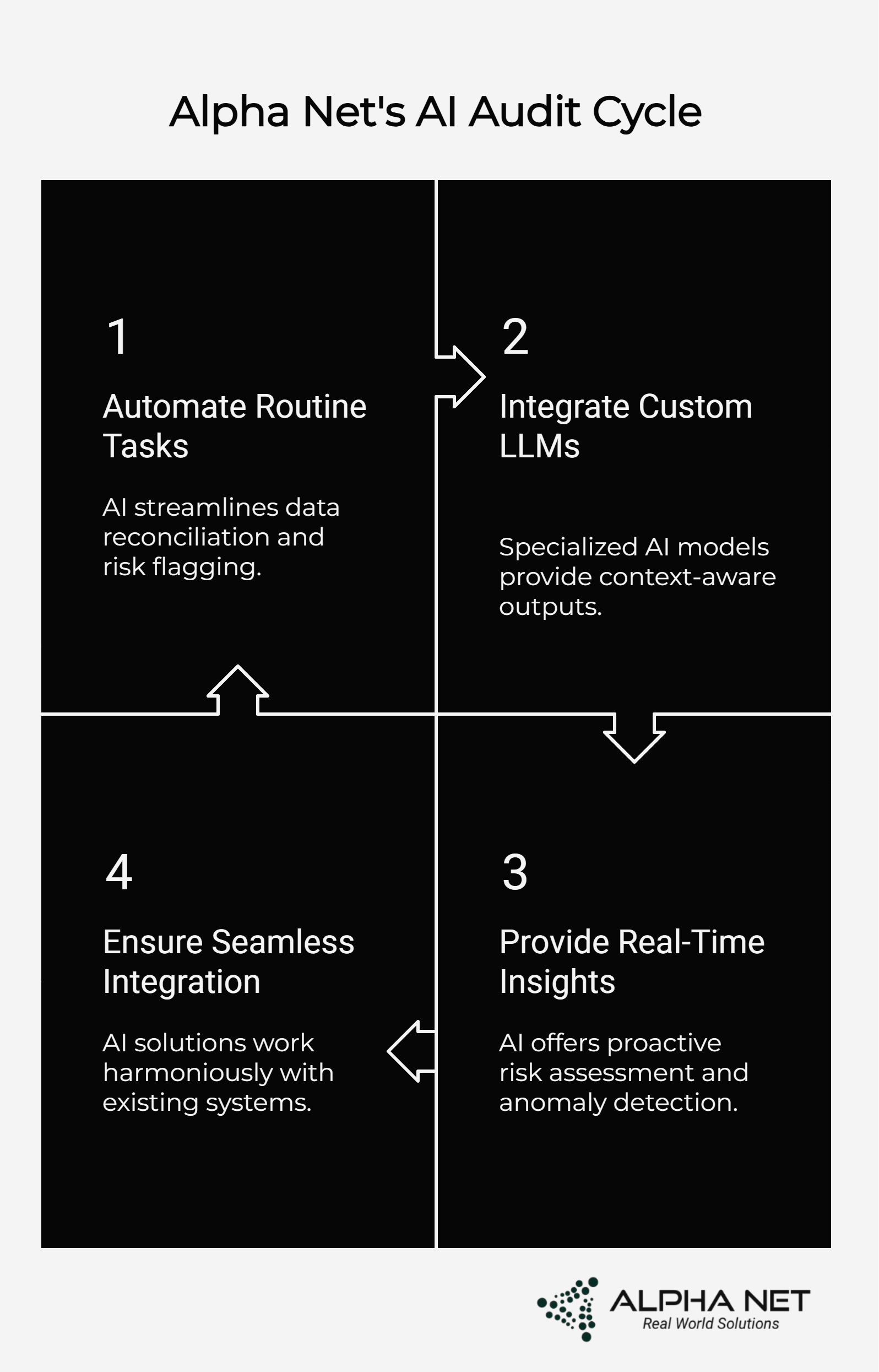

Alpha Net’s AI Solutions: Tailored for Audit Excellence

Alpha Net stands at the forefront of AI-driven audit innovation, combining cutting-edge artificial intelligence with decades of Fortune 500 audit experience. We understand that implementing AI isn’t just about having the latest technology—it’s about integrating intelligent solutions that enhance human capabilities rather than replacing them.

Comprehensive Audit Automation Platform

Automation as a Service: Our AI streamlines routine tasks from data reconciliation to risk flagging, allowing auditors to focus on strategy, client relationships, and complex analytical work that drives real business value.

Custom LLM Integration: Our Large Language Models, trained specifically on audit and compliance data, deliver precise, context-aware outputs tailored to financial services. These aren’t generic AI models—they’re specialized tools that understand the nuanced language and requirements of financial auditing.

Real-Time Insights: Alpha Net’s AI provides proactive risk assessment and anomaly detection, keeping audits ahead of potential issues. Our continuous monitoring capabilities transform audit oversight from periodic events into ongoing processes, providing real-time visibility into organizational risk and compliance status.

Advanced Integration Capabilities

Our deep expertise in enterprise resource planning systems ensures seamless integration with existing technology infrastructure. Alpha Net’s solutions work harmoniously with major ERP systems including SAP, Oracle, NetSuite, and Microsoft Dynamics, maximizing existing technology investments while enabling advanced AI capabilities.

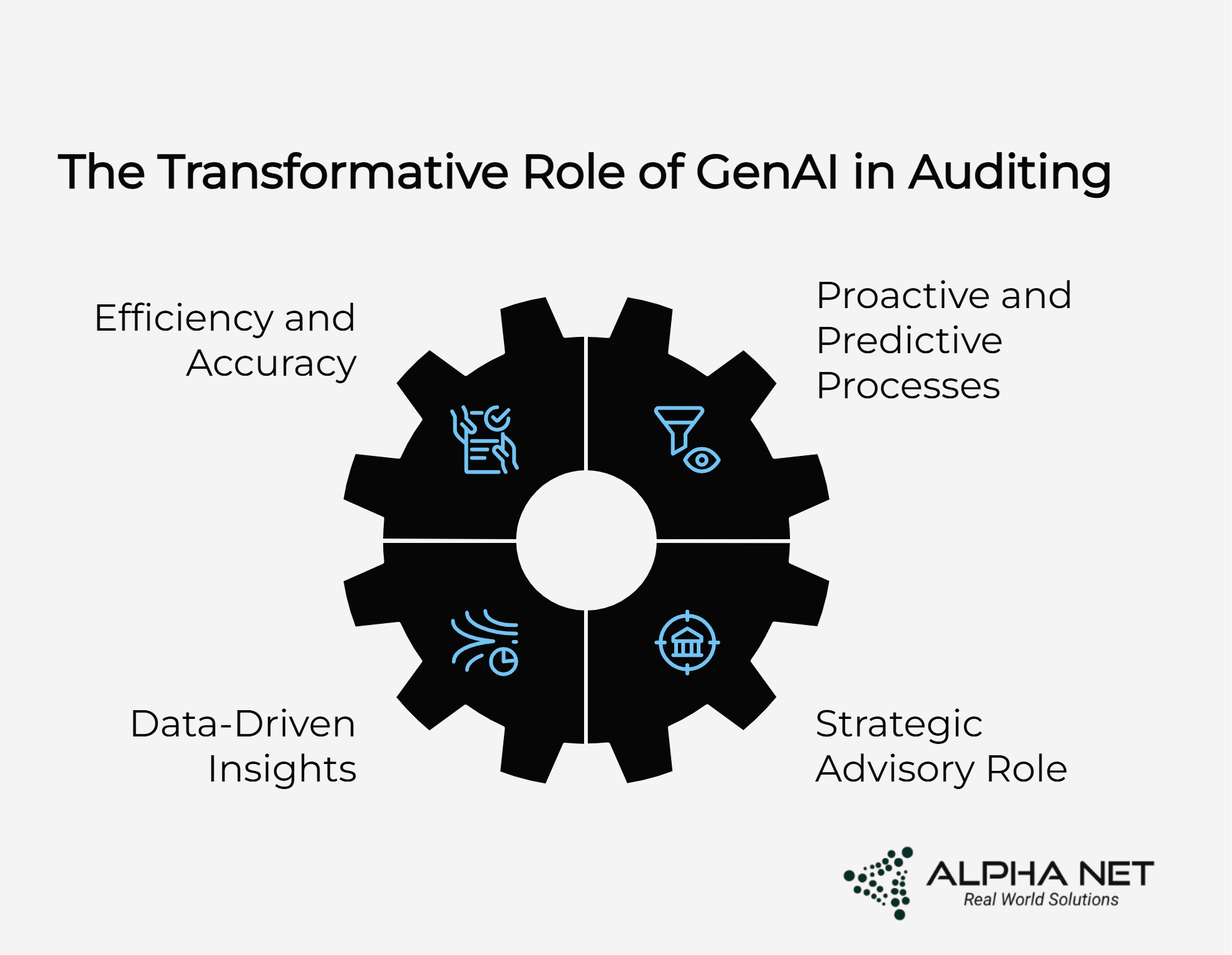

The Future of AI-Powered Auditing

The transformation of financial audits through GenAI represents more than technological advancement—it’s a fundamental shift toward more efficient, accurate, and insightful audit processes. Most companies believe that their external auditors will be using generative AI as common practice within less than two years, making early adoption a competitive advantage rather than just an operational improvement.

Organizations expect their auditors to use AI for three key purposes: improving efficiency and accuracy of audits, developing more proactive and predictive processes, and gathering data-driven insights that inform strategic decision-making. This evolution positions auditors as strategic advisors rather than just compliance checkboxes.

As GenAI continues to evolve at breakneck speed, its potential to redefine internal auditing expands exponentially, promising even more significant advancements in how audits are conducted and the strategic role of auditors in organizational governance.

Conclusion: Embracing AI-Driven Audit Transformation

Financial audits no longer need to be the dreaded annual ordeal that keeps CFOs awake at night. By implementing generative AI and automated financial auditing solutions, organizations can achieve greater accuracy, efficiency, and insight at every stage—from initial planning to final reporting and everything in between. The result is faster audits, sharper risk management, and a stronger foundation for financial trust that stakeholders can rely on.

Ready to transform your audit process with AI? The integration of AI audit software isn’t just a technological upgrade—it’s a strategic advantage that positions forward-thinking organizations ahead of their competition.

Alpha Net is uniquely positioned to turn that vision into reality through our comprehensive AI-powered audit tools that empower businesses to transform audits from compliance burdens into strategic advantages. With proven methodologies, industry-specific expertise, and cutting-edge machine learning audit technology, Alpha Net delivers the solutions necessary for successful AI audit transformation.

Take the next step: Contact Alpha Net today for a comprehensive consultation on generative AI financial audits and discover how we can help your organization stay ahead in the age of intelligent auditing. The future of automated financial auditing is here—and it’s more efficient, accurate, and insightful than ever before.

Frequently Asked Questions About AI in Financial Auditing

What is generative AI in financial auditing?

Generative AI in financial auditing refers to artificial intelligence systems that can create, analyze, and interpret audit documentation, automate testing procedures, and generate insights from financial data to improve audit efficiency and accuracy.

How does AI improve audit accuracy?

AI audit software improves accuracy by eliminating human computational errors, consistently applying testing procedures, identifying subtle patterns in large datasets, and detecting anomalies that might be missed in manual reviews.

What are the cost savings of automated financial auditing?

Organizations typically see 30-50% reduction in audit time, with corresponding cost savings. AI-powered audit tools can reduce data analysis time by up to 50% while improving overall audit quality.

Is AI audit software compatible with existing systems?

Modern AI audit solutions integrate seamlessly with major ERP systems including SAP, Oracle, NetSuite, and Microsoft Dynamics, maximizing existing technology investments.

What types of fraud can AI detect in audits?

AI can identify unusual transaction patterns, timing anomalies, duplicate payments, vendor fraud schemes, revenue manipulation, and other sophisticated fraud indicators through machine learning algorithms.